The Power of Transformation: A Case Study on Cadence Bank Rebranding

- Nour Alhamwi

- Feb 24, 2023

- 5 min read

Updated: Feb 27, 2023

Cadence Bank is one of the most successful banks in the US. They have been providing financial services since 1868 and have built a solid reputation in the banking industry. Over the years, the bank's customers have come to trust them for their reliable services, but the brand was starting to show signs of stagnation. In order to stay competitive, Cadence Bank decided to undergo a rebranding process to give their brand a much-needed update.

Introduction to Cadence Bank

Cadence Bank is a regional bank based in Birmingham, Alabama. It was founded in 1868 and is one of the oldest banks in the US. The bank offers a wide range of services, including personal banking, business banking, and wealth management. Over the years, Cadence Bank has built a strong reputation in the banking industry as a reliable and trustworthy provider of banking services.

However, in recent years, the bank noticed that their brand was starting to show signs of stagnation. They knew that in order to stay competitive in the banking industry, they needed to undergo a rebranding process to give their brand a much-needed update.

Cadence Bank's Branding Strategy

When it came time to rebrand, Cadence Bank decided to focus on their core values of trust, stability, and customer service. They wanted to ensure that their rebranding was in line with their core values, so they developed a branding strategy that would emphasize their commitment to these values.

First, Cadence Bank changed their logo to a modern, simple design that was more in line with their core values. They also developed a new tagline – “Your trusted partner.” This tagline was designed to emphasize the bank’s commitment to providing reliable services to their customers.

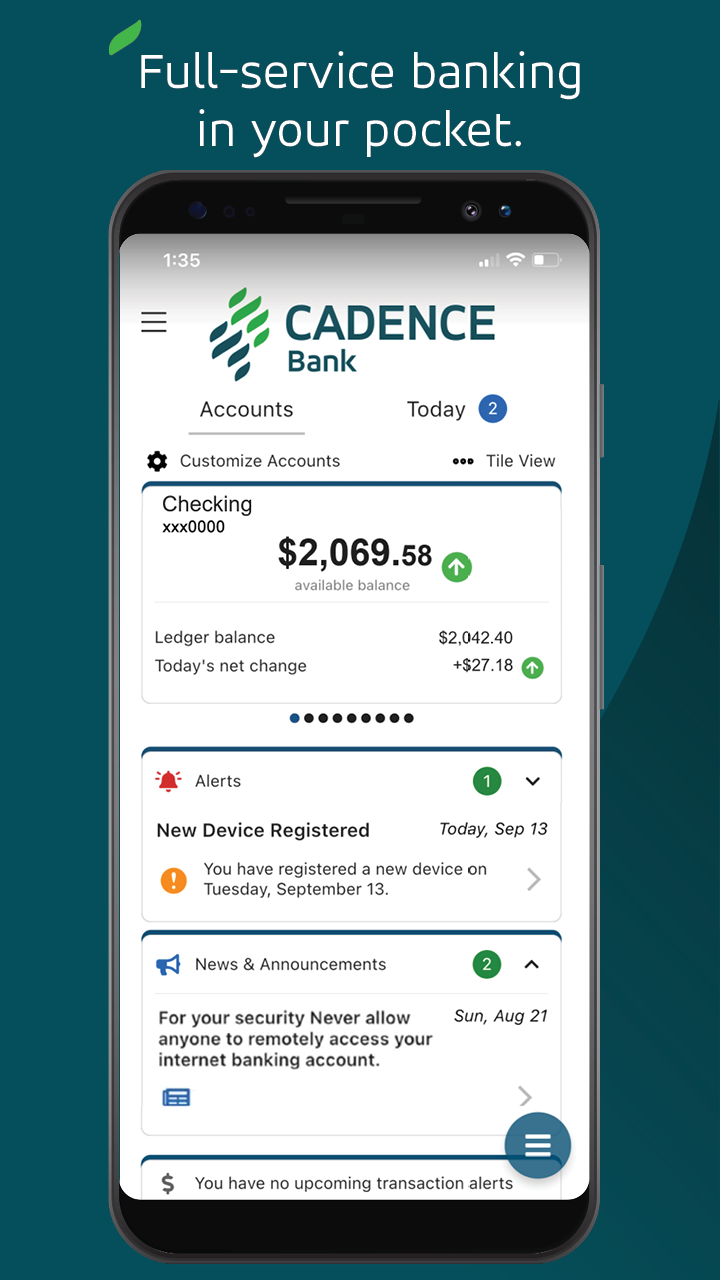

To further emphasize their core values, Cadence Bank also redesigned their website and created an updated look and feel for their branding materials. They also began to focus more on digital marketing, using social media and other digital platforms to reach their target audience.

Challenges Faced by Cadence Bank

Not surprisingly, Cadence Bank faced several challenges during their rebranding process. One of the biggest challenges was convincing their customers that their rebranding was legitimate and not just a marketing ploy. Many of the bank’s customers had been with them for years and were hesitant to accept the changes.

Another challenge was to ensure that their rebranding efforts were effective. Cadence Bank had to find a way to make sure that their rebranding efforts were reaching their target audience and driving the desired results.

Finally, Cadence Bank had to ensure that their rebranding efforts were cost-effective. They had to find ways to rebrand without breaking the bank.

Cadence Bank's Rebranding Process

In order to overcome these challenges, Cadence Bank developed a comprehensive rebranding process. First, they conducted extensive market research to identify their target audience and understand their needs. This allowed them to develop a more effective branding strategy.

Next, Cadence Bank developed a comprehensive branding package, which included a new logo, tagline, website, and other branding materials. They also developed a comprehensive digital marketing strategy to ensure their rebranding efforts reached their target audience.

Finally, Cadence Bank implemented their rebranding efforts. They launched their new branding materials, updated their website, and began to focus more on digital marketing.

The Impact of Cadence Bank's Rebranding

Cadence Bank’s rebranding efforts have had a significant impact on their business. After the rebranding, the bank saw an increase in customer engagement and a boost in brand awareness. The bank’s customers began to trust the brand more and were more likely to recommend it to others.

The bank also experienced an increase in customers and revenues. The rebranding process allowed them to reach more potential customers and convert more leads into customers. As a result, the bank’s revenues increased significantly.

Overall, Cadence Bank’s rebranding was a success. The bank was able to create a new and improved brand identity that resonated with their target audience. They also increased customer engagement and revenue through their comprehensive digital marketing strategy.

Branding Lessons from Cadence Bank

The rebranding process of Cadence Bank can provide valuable lessons to other banks looking to rebrand. The most important lesson is that it’s important to focus on your core values. Cadence Bank’s rebranding process was successful because they ensured that their branding was in line with their core values of trust, stability, and customer service.

Another lesson is that it’s important to conduct extensive market research. Cadence Bank’s rebranding efforts were successful because they conducted extensive market research to identify their target audience and understand their needs. This allowed them to develop a more effective branding strategy.

Finally, it’s important to focus on digital marketing. Cadence Bank’s rebranding efforts were successful because they focused on digital marketing to reach their target audience.

Benefits of Rebranding for Banks

Rebranding can be a great way for banks to stay competitive and increase their revenues. Rebranding allows banks to refresh their image and reach new customers. It also allows banks to differentiate themselves from their competitors and build a strong brand identity.

Rebranding can also help banks increase customer engagement and loyalty. By refreshing their image and emphasizing their core values, banks can remind customers why they chose them in the first place. This can help increase customer loyalty and trust in the bank.

Challenges Banks May Face in Rebranding

While rebranding can be an excellent way for banks to stay competitive, it has its challenges. Banks may face difficulty in convincing their customers that their rebranding is legitimate and not just a marketing ploy. They may also face difficulty ensuring that their rebranding efforts are practical and reach their target audience. Finally, banks may face problems providing their rebranding efforts are cost-effective.

Best Practices for Banks to Rebrand

There are several best practices that banks should follow to ensure that their rebranding efforts are successful. First, banks should focus on their core values. Rebranding efforts should align with the bank’s core values to ensure effective rebranding.

Second, banks should conduct extensive market research. This will allow banks to identify their target audience and understand their needs. This will enable them to develop a more effective branding strategy.

Third, banks should focus on digital marketing. Digital marketing can help banks reach their target audience and drive the desired results.

Conclusion

Rebranding can be a great way for banks to stay competitive and increase their revenues. Cadence Bank’s rebranding efforts have been successful and have had a significant impact on their business.

Rebranding can be challenging, but by following the best practices outlined in this blog, banks can ensure that their rebranding efforts are successful. If you are looking to rebrand your bank, contact Branding Elm Agency today. We’ll help you create a powerful brand identity that will help you stay competitive and increase your revenues.